Record Backlog Purchase Orders of $42.9 Million at Quarter End

Highly Anticipated New Product Lines Announced; Includes Commercial Aircraft Cabin Shading, ADAS Smart Vision for Buses, and Pre-Fabricated Stacks for Smart Glass

New Strategic Customers Secured in Architecture, Aeronautics and Safety Tech

Closed on $15 Million of Debt Financing with Mizrahi Bank, Israel’s Third Largest Bank, Including $5 Million in July

Reaffirms 2025 Guidance

TEL-AVIV, Israel and NEW YORK, Aug. 13, 2025 (GLOBE NEWSWIRE) — Gauzy Ltd. (Nasdaq: GAUZ) (“Gauzy” or the “Company”), a global leader of vision and light control technologies, today announced financial results for the second quarter ended June 30, 2025.

Second Quarter 2025 Highlights (Compared to Second Quarter 2024)

- Revenues of $20.1 million, compared to $24.4 million

- Gross margin of 21.4%, compared to 27.0%

- Net loss of $10.7 million compared to a net loss of $23.1 million

- Adjusted EBITDA1 of ($8.7) million compared to ($3.9) million

- Purchase order backlog of $42.9 million compared $36.2

- Total available liquidity of $36.2 million, including cash of $1.2 million and $35.0 million undrawn credit facility at quarter end

Six Months 2025 Highlights (Compared to Six Months 2024)

- Revenues of $42.4 million, compared to $49.1 million

- Gross margin of 23.6%, compared to 26.1%

- Net loss of $21.5 million compared to a net loss of $36.3 million

- Adjusted EBITDA1 of ($14.1) million compared to ($8.7) million

1 Adjusted net loss and Adjusted EBITDA are financial measures that are not required by, or presented in accordance with, U.S. GAAP. Please see Annex A of this release for a reconciliation of Adjusted net loss to net loss and Adjusted EBITDA to net income (loss), the most directly comparable financial measures stated in accordance with GAAP for each of the periods presented.

“We were pleased to see solid momentum with our multi-year contracted backlog of purchase orders growing to a record $42.9 million at quarter end alongside several key business milestones that strengthen our overall competitive position,” commented Eyal Peso, Gauzy Co-Founder and Chief Executive Officer. “Our customer General Motors has begun delivering Cadillacs with the largest ever smart glass panel in a vehicle that uses our SPD technology, marking another milestone in the EV sector. We launched a breakthrough smart glass product, a prefabricated smart glass stack, that will accelerate automotive OEM adoption of dynamic glazing. Additionally, we are expanding into the strategic high margin marine market following successful installation of our technology at the MSC terminal in Miami, and we are supporting commercial spaces for some of the biggest brands in the world, like Moderna.”

“Importantly, we have seen some customers more than double orders for the year during the second quarter, and demand remains strong, however dynamics in the timing of our shipments are reflected in our results,” Peso continued. “In light of that, we expect our full year results to be heavily weighted towards the second half.”

Peso concluded, “We have a stronger balance sheet and record backlog that put us on firm footing into the second half. We are reaffirming our full year guidance, reflecting our confidence in our ability to execute on the substantial opportunities ahead. My conviction in Gauzy’s strategic direction and growth remains as strong as ever, as evidenced by the significant purchase of shares I made during the quarter. We look forward to delivering on our goals and creating exceptional shareholder value.”

Top Business Milestones and Accomplishments Since Last Earnings Release

- First customer deliveries of General Motors’ Cadillac CELESTIQ with industry’s largest Smart Glass panel with Gauzy SPD

- Launched its prefabricated Smart Glass Stack, accelerating automotive smart glazing Adoption by Tier 1s and OEMs

- Expansion into strategic, high margin marine sector including nine marine contracts to date

- New major cities equipped with Smart-Vision ADAS on bus fleets now include Manchester, U.K. and Strasbourg, France

- Major companies like Moderna choose Gauzy LCG® smart glass for commercial spaces and company headquarters

- New products to be launched and revealed include AI-Powered ADAS Smart-Vision for Buses, and commercial cabin shading in Aeronautics

- CEO purchased 210,000 shares during second quarter as previously announced

Second Quarter 2025 Results

Revenues for the second quarter were $20.1 million compared to $24.4 million in the prior year quarter. The difference was primarily driven by multiple segments experiencing shifts in the timing of deliveries, which are not expected to impact full year deliveries.

Gross profit for the second quarter was $4.3 million compared to $6.6 million in the prior year quarter. Gross margin for the second quarter was 21.4% compared to 27.0% in the prior year quarter, primarily attributable to lower revenues over a fixed cost base, particularly in Aeronautics.

Total operating expenses for the second quarter were $16.8 million, compared to $14.5 million in the prior year quarter, mainly due to higher corporate expenses associated with being a public company versus a private company during the same quarter last year, as well as higher D&A and R&D.

Net loss for the second quarter was $10.7 million compared to $23.1 million in the prior year quarter, mainly due to a decrease in financial expenses and interest expense, partially offset by an increase in total operating expenses and a decrease in gross profit.

Adjusted EBITDA for the second quarter was ($8.7) million compared to ($3.9) million in the prior year quarter, primarily driven by the same factors outlined above for gross profit and operating expenses.

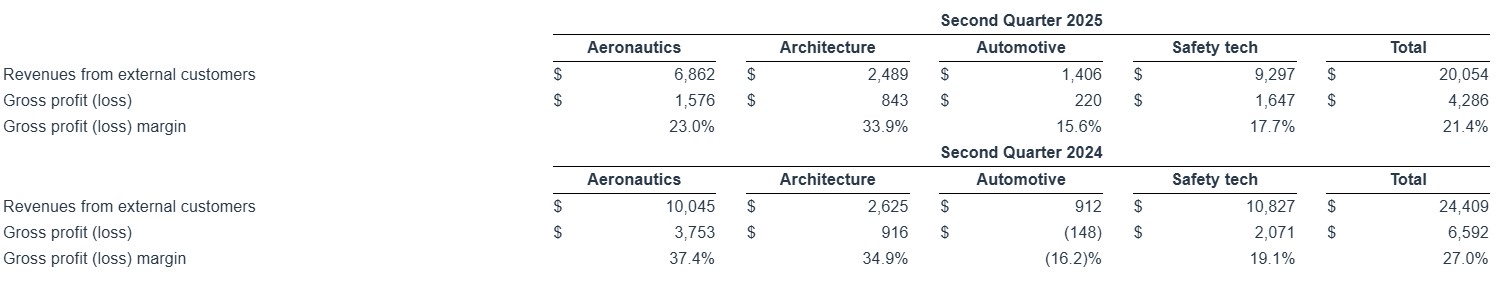

Segment Performance

(U.S. dollars in thousands)

Balance Sheet, Liquidity and Cash Flow

As of June 30, 2025, the Company had total liquidity of $36.2 million, including $1.2 million of cash and cash equivalents and $35.0 million of available capacity under its undrawn credit line. At quarter-end total debt was $53.0 million, including $9.2 million of short-term receivable financings. During the quarter the Company closed on $10 million of debt financing with Mizrahi Bank, Israel’s third largest bank, and subsequent to quarter end expanded borrowings by an additional $5 million under similar terms with Mizrahi Bank, further enhancing liquidity. The Company remains committed to funding the business through non-dilutive capital sources and expected future cash flows.

Guidance

The Company continues to expect full year revenue to be in the range of $130 million to $140 million. Based on the benefit of scale, favorable operating leverage and strong recurring revenue base, the Company expects Adjusted EBITDA to be positive for the full year 2025.

Conference Call and Webcast:

Gauzy will host a conference call and webcast to discuss its results for the second quarter ended June 30, 2025 and other information related to its business at 8:30 a.m. Eastern Daylight Time on Wednesday, August 13, 2025. The webcast of the conference call can be accessed on the “Investors” section of Gauzy’s website at www.investors.gauzy.com. For those unable to access the website, the conference call will be accessible domestically and internationally, by dialing (800) 717-1738 or (646) 307-1865, respectively. Upon dialing in, please request to be connected to the Gauzy earnings conference call. To access the replay of the call, dial (844) 512-2921 (Domestic) or (412) 317-6671 (International) and enter the passcode 1112120.

About Gauzy

Gauzy Ltd. is a fully-integrated light and vision control company, focused on the research, development, manufacturing, and marketing of vision and light control technologies that are developed to support safe, sustainable, comfortable, and agile user experiences across various industries. Headquartered in Tel Aviv, Israel, the company has additional subsidiaries and entities based in Germany, France, the United States, Canada, China, Singapore, and the United Arab Emirates. Gauzy serves leading brands across aeronautics, automotive, and architecture in over 60 countries through direct fulfillment and a certified and trained distribution channel.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements contained in this press release include, but are not limited to, statements regarding Gauzy’s strategic and business plans, technology, relationships, objectives and expectations for its business, growth, the impact of trends on and interest in its business, intellectual property, products and its future results, operations and financial performance and condition and may be identified by the use of words such as “may,” “seek,” “will,” “consider,” “likely,” “assume,” “estimate,” “expect,” “anticipate,” “intend,” “believe,” “do not believe,” “aim,” “predict,” “plan,” “project,” “continue,” “potential,” “guidance,” “objective,” “outlook,” “trends,” “future,” “could,” “would,” “should,” “target,” “on track” or their negatives or variations, and similar terminology and words of similar import, generally involve future or forward-looking statements. In particular, forward-looking statements in this press release include its anticipated revenues and other results for the year ended December 31, 2025. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements reflect Gauzy’s current views, plans, or expectations with respect to future events and financial performance. They are inherently subject to significant business, economic, competitive, and other risks, uncertainties, and contingencies. Forward-looking statements are based on Gauzy’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. For a more detailed description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s Annual Report on Form 20-F filed with the SEC on March 11, 2025 and in subsequent filings with the SEC. The inclusion of forward-looking statements in this or any other communication should not be considered as a representation by Gauzy or any other person that current plans or expectations will be achieved. Forward-looking statements speak only as of the date on which they are made, and Gauzy undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as otherwise required by law.

Non-GAAP Disclosure

In addition to Gauzy’s financial results reported in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”), this press release and the accompanying tables and related presentation materials may contain one or more of the following Non-GAAP financial measures: Adjusted Net Loss, EBITDA, Adjusted EBITDA, Net Loss Margin and Adjusted EBITDA Margin. Gauzy believes that these measures provide useful information about its operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key measures used by management in its financial and operational decision making. Non-GAAP financial measures have limitations as analytical tools and may not be comparable to companies in other industries or within the same industry with similarly titled measures of performance. In addition, these non-GAAP measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. The presentation of this financial information is not intended to be considered as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. Investors are encouraged to review the related U.S. GAAP financial measures and the reconciliation of these Non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures and not rely on any single financial measure to evaluate our business.

Adjusted Net Loss. The Company defines Adjusted Net Loss as Net Loss, adjusting for certain financial expenses, the amortization of intangible assets, certain acquisition and debt raising related costs, non-cash fair value adjustments and expenses related to equity-based compensation and doubtful debts.

EBITDA. The Company defines EBITDA as Net Loss, excluding net financial expense, tax expense and depreciation and amortization.

Adjusted EBITDA. The Company defines Adjusted EBITDA as EBITDA (as defined above) excluding acquisition-related costs, one-time expenses, equity-based compensation expenses and doubtful debts.

Net Loss Margin. The Company defines Net Loss Margin as Net Loss for the period divided by revenue for the same period.

Adjusted EBITDA Margin. The Company defines Adjusted EBITDA Margin as Adjusted EBITDA (as defined above) for the period divided by revenue for the same period.

For more information on the Non-GAAP financial measures, please see the reconciliation tables provided in this press release. The accompanying reconciliation tables have more details on the U.S. GAAP financial measures that are most directly comparable to Non-GAAP financial measures and the related reconciliations between these financial measures.

Contacts

Media:

Brittany Kleiman Swisa

Gauzy Ltd.

press@gauzy.com

Investors:

Dan Scott, ICR Inc.

ir@gauzy.com